- You are here:

- Home

-

- Finance

-

- Products and services

-

- Insurance Products

-

- IFRS 17

IFRS 17 solution

The Asseco IFRS 17 solution is an out-of-box reporting solution delivered on the same software platform as the Asseco Solvency II Engine and Asseco Scenario Analysis Tool. The Asseco Aggregation Engine, as the software platform is called, is aimed at assisting insurance companies with dedicated process handling of important insurance business processes. (Apart from the Asseco SII Engine and the Asseco Scenario Analysis Tool, the Asseco Aggregation Engine is also the platform for the Asseco Bordereaux & Claims Management solution, which handles the control, validation and transformation of insurance business data, both Risks–policy/contract/cover and Claims, including the matching of said claims with the covers.)

The Asseco Aggregation Engine is a platform for the handling of insurance specific business processes and core insurance data management processes on different levels of aggregation, including detailed policy/cover level and highly aggregated business portfolio level.

|

On this basis, the Asseco Aggregation Engine is an ideal platform for handling the required business processes of IFRS 17 in a fully controlled and audit-trailed environment:

- Calculation and handling of data on the required aggregated and/or Group/Unit of Account Level

- Sensitivity analysis as required by IFRS 17 Disclosures, as well as for management purposes (the Asseco Scenario Analysis Tool)

- Aggregation of data for Regulatory reporting

- Mapping of data to IFRS 17 specified reporting and disclosure templates

- Integrating to actuarial, policy, financial systems via standard Data Marts, both for input and output

- Real-time comparison of calculated results and reports to previous/historic versions of

the individual results/reports, including drill-down to source

Furthermore, Asseco has many years of experience with the Asseco Aggregation Engine, core data management processes, maintaining and securing compliant Regulatory reporting solutions, IFRS 17 knowledge from an actuarial and finance perspective and supporting 100+ finance sector institutions across Europe on a day-to-day basis.

Main information

Asseco IFRS 17 solution architecture

Hardware and software requirements

Asseco Insurance References

|

|

|

|

|

Hardware and software requirements

| Recommended Hardware sizing (Production, Pre-prod, Test): |

Recommended MS System Software: |

|

|

The Prod, Pre-prod and Test environment can also be a Linux operating system or PostGrSQL

DBMS systems. Please request more information if this is relevant.

Besides the necessary software prerequisites, there is no need for additional third-party

software or other licenses to be purchased when using the Asseco IFRS 17 solution.

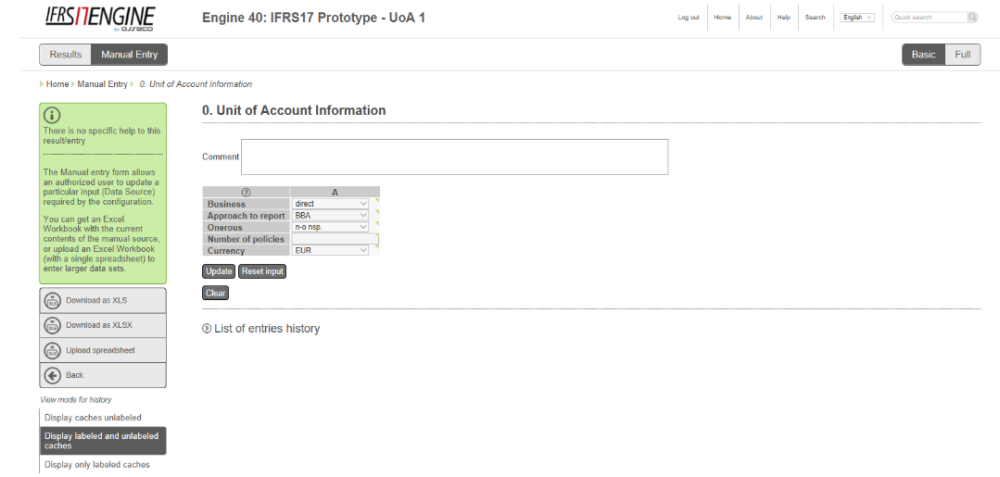

Key functionalities

In the Asseco IFRS 17 solution (after the required approvals), the Calculation Engine calculates all the required data on UoA or aggregated level (depending on the Client’s request), handles the CSM calculations and other IFRS 17 specific calculations, e.g. the present value of cash in- and outflows, amortization, loss component, etc.

The concept of the system is organized around the Unit of Accounts and the Aggregation of the calculation result of the Unit of Accounts.

Some functionalities supported by our solution:

- Separating the accounting periods (attached to the prior, adjacent period)

- Importing the closing data from the prior period (automatically)

- Importing IFRS17 consistent

- projected and actual cash-flow data (including policy choices, product characteristics, coverage units, credited rate, and if applicable, modified contracts)

- current discount rates linked to cash-flows

- all Unit of Account (Group of Insurance Contracts) levels

- Checking data and providing ALERTs and ERRORs against prior period data and new requirements, and their consistency

- Approval of uploaded data/dataset

- management of missing actual data, as well as missing projected data

- approval based on the pre-set authoritisation matrix

- executing the calculations for all UoAs

- BBA, PAA, and/or VfA methods or Manual (with pre-defined authorization levels)

- onerous/non-onerous

- direct/reinsurance held

- Generating closing data

- initial recognition (LRC-PVFC, LRC-RA, CSM, LossC)

- subsequent measurement

- LRC-PVFC, LRC-RA, CSM, LossC, LIC-PVFC, LIC-RA, OCI

- reconciliation of the above as required (PnL, CF, OCI)

- PnL elements (insurance revenue, insurance service expense, insurance finance income or expense), as well as movement of OCI

- sensitivity analysis required by the IFRS 17 Standard

- Aggregating the result

- build on data hierarchy (necessary)

- user defined hierarchy

- Closing

- approval or correction ((partial) rejection – back to data upload)

- upon approval

- time stamping the final input data

- time stamping the output

- generating the closing items for the next accounting period

- IFRS correction (opening back for unlimited periods, generating difference report – subject to high level approval)

- Each Unit of Account (later: UoA) data can be imported and approved separately

- Options to manage missing cash-flows

- IFRS17 consistent actual cash flows from the G/L or a datamart are uploaded and checked against preset and imported validation rules

- IFRS17 consistent projected cash flows from the actuarial system or a datamart are uploaded and checked against preset and imported validation rules (discount rates are imported along with the respective projected cash-flows)

- IFRS 17 Standard compliant reports are prepared, based on the appropriate aggregation

- It is possible that the reporting frequency is higher than the length of the UoA. This requires that new policies are added to the already presented UoA.

- Separate monitoring is available to ensure the consistent transition from phases when LRC and LIC co-exist to the single LIC option, as well as to the final derecognition of the UoA.

Data input

We have an assumption that our Cients will identify/have identified portfolios of insurance contracts in line with IFRS 17 standard, and we also presume that you have subdivided the portfolios into Groups.

Asseco will define the group and structure of the IFRS 17 consistent data, which is requested by the IFRS 17 Solution.

The Unit of Account (UoA) definition we operate with is:

- Groups of contracts (Unit of Account)

- Subject to similar risk

- Managed together

- Profitability

- Onerous at initial recognition

- Profitable with a significant possibility of becoming onerous.

Input adapter module

As the input for calculations, the solution has a range of standardised data requirements to be delivered from the actuarial solution (assumption), i.e. projected fulfilment cash flow, discounted, risk adjusted, coverage units information for a given Group of contracts/Unit of Account.

Furthermore, we assume the delivery of actual cash flow data, including deviations effecting past, current and future services.

The actual cash flow must have the same data structure and Unit of Account structure as the projected cash flows. It is mandatory to ensure the comparability of the actual and the projected data.

The difference between these values is reported in the relevant financial statement rows.

The Asseco IFRS 17 solution needs to get actual data and projected cash flows, for all Unit of Accounts, in every reporting period. However, there is an option to use previously input data/”revert to”, of any Unit of Account, if there is no new projection cash flow (approval flows can be configured in regard to such a “revert to” process).

We have an assumption that our Client will be able to deliver both the projected and the actual cashflows per Units of Account from their existing system. If required, our consultants and experts are there to help our Clients in this task as well.

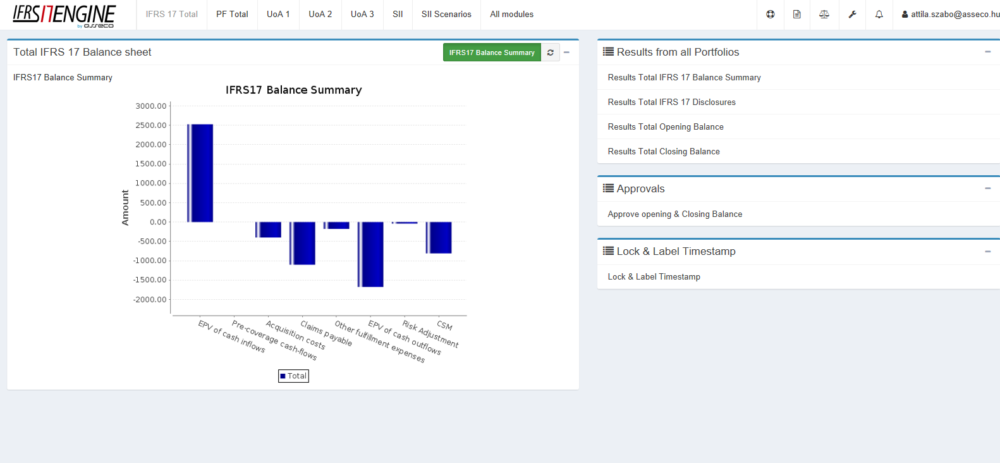

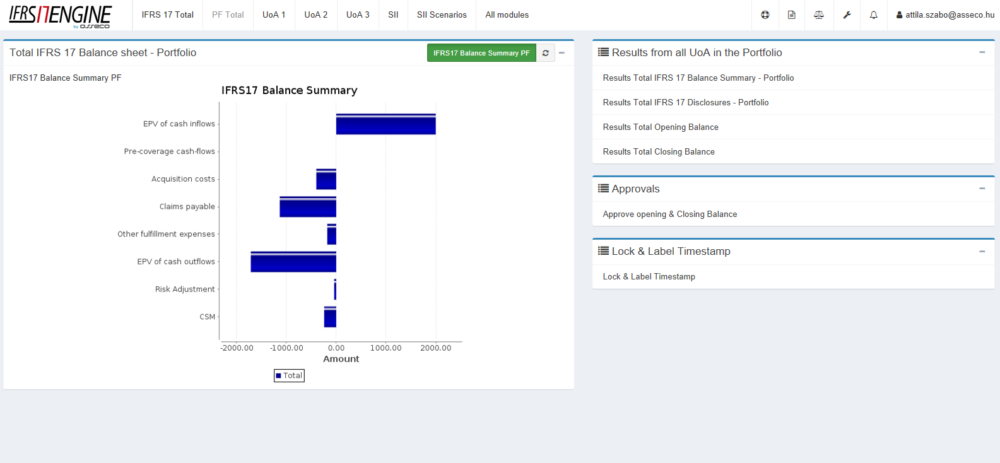

Solution output

System checks and validations

Prior to running the IFRS 17 calculations, the Asseco IFRS 17 solution will execute a range of built-in automatic system checks and validations, so that an IFRS 17 consistent output can be generated. Asseco IFRS 17 solution can deliver the out-of-the-box, as well as customer-specific and reconciliation reports.

The detailed Results table shows the draft structure of the report, allowing for a detailed insight both on UoA and on aggregated levels.

Within the Asseco IFRS 17 reporting solution, it is easy to monitor the effect of all the factors and find the Errors retrospectively.

IFRS 17 reporting module

The Asseco IFRS 17 solution will provide the full range of the IFRS 17 Standard required reports, e.g. IFRS17 Balance Sheet, Profit & Loss Statement, Notes and Disclosures.

For example (but not limited):

- consolidated statement of profit and loss

- consolidated statement of financial position (‘Balance Sheet’), as at the end of the

period - statement of profit and loss and other comprehensive income for the period

- statement of changes in equity for the period

- statement of cash flow movements for the period

- notes comprising a summary of significant accounting policies and other

- explanatory information

- reports on opening and end balance

- detailed income statement.

IFRS 17 Subledger

Postings can be exported from the IFRS 17 subledger to the IFRS 17 Data Mart for interfacing with the primary ledger if the General Ledger is prepared to accept the IFRS 17 consistent posting items.

Custom Reports

We are aware that all Clients are different.

Our Clients can have the opportunity to design and implement their own custom reports, which e.g. could include dashboard reports, regarding the comparison of key figures with historic values, etc.

It is important that the custom reports will also be:

- available online on any device in the secure Asseco Aggregation Engine environment that you set up

- Controlability and auditability – access rights, approval workflows, audit trails

- Automated data sourcing from a range of sources – file formats, JDBC compliant, Databases, web services

- History and transperancy – comparisons over time, drill down for data analysis

- Automated distribution and alerts to relevant stakeholders can be set up.

Screenshots

Asseco Aggregation Engine creates a standard web service for any and all the reports in the system, which can be used for exporting e.g. to the parent company’s reporting system.

Controls and Audit Trails

In the Asseco IFRS 17 solution, you can set up roles, access controls and company-specific workflows regarding work processes and approvals.

We have designed the solution (like the SII Engine) based on a pragmatic approach, i.e. based on the everyday work life experiences of Actuarial, Risk management and Reporting departments of insurance companies, rather than those of a process consultant.

Workflows and approval processes are set up “at the click of a button”.

Roles and access controls are set up during the installation phase, and they can be amended by the customers themselves at any point in time.

The solution differentiates/ensures the segregation of duties by different user roles by applying the set of roles needed to support. Once implemented, the roles and rights administration will be enforced by the system. Basically, any part of the system is configured with its own set of user rights, securing that only users with the proper authorization can access or update it.

As for the Asseco personnel, if required, they can put a control in place to ensure that the access of the system admin and any privileged user accounts is restricted and controlled.

We have the following roles pre-defined in the system (further roles can be added):

- Read-only right

- Write right

- Approval right

- Audit right

- Administrator right

As mentioned above, we can reuse information about the relevant users from your current access management systems, such as Microsoft AD, LDAP etc., but you can also define users, roles and access controls in the solution’s own user repository.

It is possible to set up workflows on a report level, a data input level regarding the validity of the data. Furthermore, you can also set up of thresholds and required approvals, if these thresholds are exceeded, etc.

During the reporting process (as an inbuilt function), our Clients can also set up:

- Workflow reports, showing if the data is updated, not updated or about to expire. The workflow report can show, who is responsible for updating the data,

- Functionality can be set up, where persons/roles in charge of validity of the data input and/or a report will be alerted, if actions are needed from them,

- Our Clients can subscribe to the deadlines in the workflow process, and will be alerted if the data and/or the report you are in charge of, needs a valid data input,

- Approval rules can be set up; you can subscribe to deadlines in the workflow process and be alerted, if the data and/or the report you are in charge of, needs your approval in order to be processed

- Processes can be set up where persons/roles are alerted to changes in the configuration/dashboard reports (this would not take place in the production environment, where standard reports must remain unchanged, and controls will prohibit this. In a test environment you might have less rigid controls)

In regard to actions related to data input(s), and the results of any calculations, validations, reports generation, approvals etc., there is a full and comprehensive audit trail, including logging and time stamping. The traceability of the Data element will be used as the default with timestamp; name of source/person; module where the data is sourced from and validity.

Furthermore, the solution also consists of the following features to assist with control and audit:

- Full printable audit summary reports of all calculations and data flows

- Backup and archive procedures for models, parameters and outputs

- Fully integrated source control for model development.

Validation and approval workflows

The Asseco IFRS 17 solution offers a functionality to drill down to the lowest level of granularity of input data, compare any two generations of e.g. reports or input data at any level, thus can identify issues with data quality, data gaps, and immediately evaluate the effect of these issues on the calculations and reports.

This will enable our Clients to prioritize issues according to the effects, thus improve data quality and data availability, where it matters the most in regard to the IFRS 17 process.

Through the offered functionality, the end user can quickly and efficiently implement client specific data validations and controls, strengthening data quality management, where needed.

In terms of cross-checking capabilities, the solution offers a functionality to set up and cross-check input data fields, or output data distributed across the Report, at the users’ request.

This includes checks on the data within the Data Mart data input for a full and comprehensive calculation/reporting in place, or if any data input is missing.

Export of data, Results, Reports

All results and reports including the CSM data can be exported using direct export to DWH/Data marts, source systems, manual download in spreadsheets, csv files, etc.

Data Security

The ensurance of data security of the Asseco IFRS 17 solution is of the highest priority for us. Therefore, the Asseco Aggregation Engine is very adaptable to client’s security policies.

Access is ensured through integration to the current security system, which needs to be checked by Asseco. All logon attempts are logged by the tomcat application server. For password complexity and change, we refer to internal policies.

Asseco’s company information security policies and standards are reviewed at least annually.

The Asseco IFRS 17 solution works on the “First Come, First Served” principle, enforced by appropriate locks at table level, when updating instances of data. In this way, the system can avoid conflicts in access and changing of data.

All the Asseco IFRS 17 report related data (input, output, reports, timestamps, auditablility, etc.) will be stored in our Clients’ DW/databases.

Technical requirements

The Asseco IFRS 17 solution and the underlying platform, the Asseco Aggregation Engine is a java-based web-application, which can be implemented on-premise, but there is also an option for a cloud-based setup.

Asseco’s offer is for on-premise installation.

Technical requirements:

1. Server 2016 Service Pack 2. We prefer using integrated security, but SQL Server authentication is also an option

2. Windows server 2016 (The server can be virtual)

3. We prefer authentication and authorization using active directory, but Tomcats integrated authentication is also an option.

4. Apache tomcat 8.5

5. Java JDK 8 64 bit

6. The Automation feature of the solution must be able to read and write files to a local folder on the application server. The application must have read/write access to this folder.

7. The solution can send mails to users, e.g. when a result is updated. To do this, we must have login information to smtp server.

Support

We suggest that the internal infrastructure support should be 1st level support, i.e. non-application support – HW, SW platform, application server, DB server and network and incident routing.

2nd level support will be provided by Asseco Central Europe Magyarorszag Zrt. with initial communication responsible for IFRS 17 incidents and the fix of incidents, which can be handled without any in-depth analysis.

Asseco Central Europe Magyarorszag Zrt. employs business analysts with IFRS 17 experience and provides support for financial institutions is a core competence of the company.

The Monday to Friday support between 9 am and 5pm (CET) and the online support portal will be available 24/7, but it can be adjusted to the Client’s needs in a „Service level agreement”.

Prior to reporting an incident, and asking for support, it is the client’s responsibility to search for and/or identify the error, including assembling the necessary documentation.

The support team will communicate via our IFRS 17 support portal, where the language of communication is Hungarian and/or English.

We help our Clients with inbuilt „HELP” functionalites, such as FAQ, Tips and Tricks and Announcements. The latter is used for information regarding releases, hot-fixes or other knowledge-worthy material.

The support provided with the software purchase is valid as long as the regular licence fee is paid, (including the regulatory changes, required in the software). The support and maintenance supports will stop with the cancellation of the licence.

The installation(s) of the software, training, customization and integration is not part of the software license fee.

The Asseco IFRS 17 solution’s implemented functionality will comply with:

- General Data Protection Regulation (GDPR)

- IFRS – International Financial Reporting Standards (IFRS17).

Custom development

The Client can request product enhancements, tailor-made solutions and reports, which can be handled in one of the following ways:

1. it is an enhancement, which Asseco decides to deliver as part of the standard version maintenance process. This means that it will be delivered with one of the annual version upgrades.

Asseco will have a dialogue with the clients requesting the enhancement, but ultimately, the decision to implement and timing is with Asseco.

2. it is an enhancement which, Asseco decides not to deliver as part of the standard version maintenance process.

Asseco will have a dialogue with the clients requesting the enhancement, and if the parties can agree to the terms and conditions of a delivery, a project is initiated.

For more information, please contact us at:

Asseco Central Europe Magyarorszag Zrt

1138, Budapest, Váci út 144-150

Attila Szabo

Email: attila.szabo@asseco.hu

Tel: +36 70 368 5884.

Find us on the fpollowing platforms: